The Difference Between a Home Inspection and a Home Appraisal

When you’re in the process of buying or selling a home, you might hear the terms “home inspection” and “home appraisal” tossed around. While both are critical steps in the home buying process, they serve different purposes and often cause confusion. Many homebuyers mistakenly think that an appraisal and an inspection are the same thing, but they’re not. Understanding the difference between the two can help you navigate the process with confidence and ensure you’re making informed decisions.

In this post, we’ll explain what each process entails, why both are necessary, and how they impact your real estate transaction.

What is a Home Inspection?

A home inspection is a thorough evaluation of the condition of a property, typically conducted by a licensed home inspector. The purpose of a home inspection is to identify any defects, safety concerns, or needed repairs that could affect the value or livability of the home.

Key elements of a home inspection include:

- Structural integrity: Inspecting the foundation, walls, roof, and other structural components to ensure there are no significant issues.

- Systems: Evaluating major systems such as plumbing, electrical, heating, and air conditioning to ensure they are functioning properly.

- Safety hazards: Identifying potential safety issues, like faulty wiring, mold, asbestos, or radon.

- Inspections of areas not visible to the naked eye: Crawl spaces, attics, and even the roof might be examined, often with specialized tools like drones or thermal cameras.

Why is a Home Inspection Important?

A home inspection helps homebuyers understand the true condition of the home they are purchasing. It’s an opportunity to uncover hidden issues that may not be immediately obvious, such as plumbing leaks, a damaged roof, or an outdated electrical system. Based on the findings of the inspection, buyers can make informed decisions, negotiate repairs, or even walk away from the deal if the issues are too significant.

Think of the home inspection as your safety net in the home buying process—it ensures that there are no nasty surprises down the road. It also gives you the opportunity to get estimates for repairs or improvements, which can help you decide whether the home is a good investment.

What is a Home Appraisal?

A home appraisal, on the other hand, is an unbiased professional assessment of a home’s value. Appraisals are typically required by lenders before a mortgage is approved to ensure that the loan amount is aligned with the market value of the home. The purpose of an appraisal is to verify that the price you’re paying for the home is fair and in line with comparable homes in the area.

Key elements of a home appraisal include:

- Comparative market analysis (CMA): The appraiser compares the home to similar properties in the same area that have recently sold. This helps determine if the home’s price is reasonable for its location, size, age, and condition.

- Evaluation of the property’s condition: The appraiser will also assess the overall condition of the home, including its foundation, roofing, and systems, but only in a limited capacity. They’re not looking for hidden issues like a home inspector would. The appraiser’s primary goal is to verify the home’s value.

- Local market trends: The appraiser takes into account the local real estate market conditions, such as supply and demand, neighborhood quality, and the home’s unique features.

Why is a Home Appraisal Important?

A home appraisal protects the lender from lending more than the property is worth. If the appraisal comes in lower than the asking price, the lender may not approve the loan or may reduce the loan amount, leaving the buyer to cover the difference.

While a home appraisal helps to protect the lender’s interests, it also provides a way for the buyer to make sure they are not overpaying for the home. If the appraised value comes in significantly lower than the purchase price, this could be a red flag, and the buyer may need to renegotiate the offer or reconsider the purchase altogether.

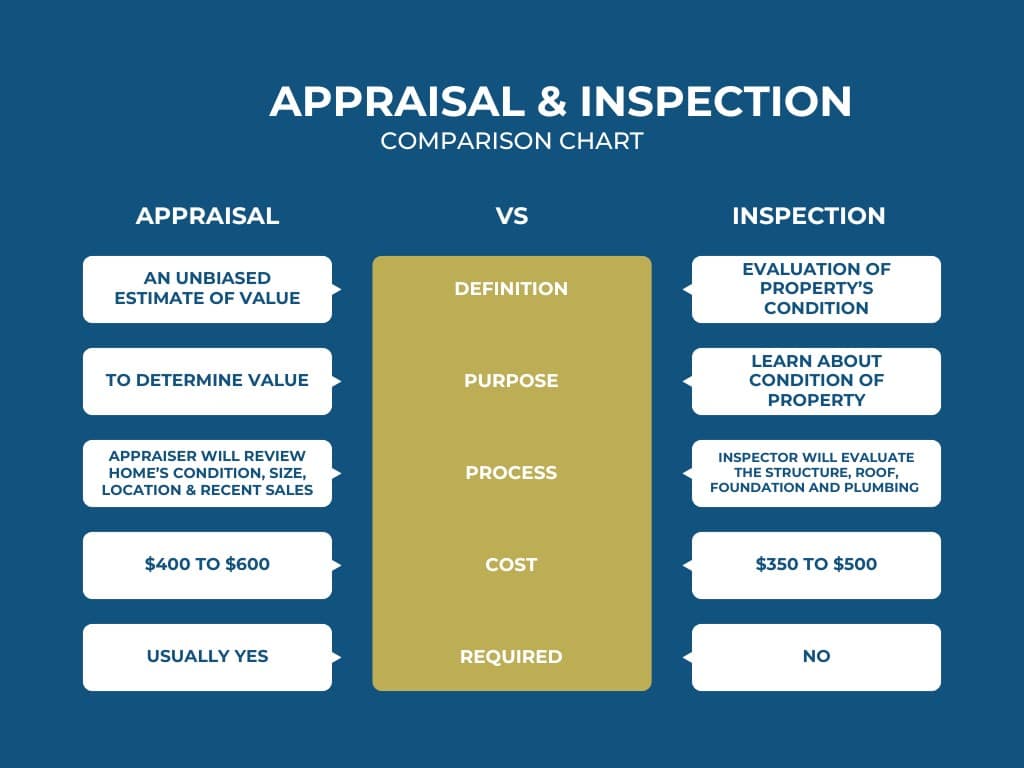

Key Differences Between Home Inspections and Appraisals

While both a home inspection and a home appraisal are essential steps in the home buying process, there are several key differences between them:

| Aspect | Home Inspection | Home Appraisal |

| Purpose | To assess the condition of the home and identify any issues. | To determine the market value of the home. |

| Performed by | Licensed home inspector. | Licensed appraiser. |

| Focus | Identifying problems that need fixing, such as safety concerns, structural issues, or outdated systems. | Assessing the home’s value based on comparable properties. |

| Who pays for it? | Typically paid by the homebuyer. | Usually paid by the homebuyer, but sometimes the seller. |

| Timing | Occurs after the offer is accepted but before closing. | Usually happens after the home inspection, often as part of the mortgage approval process. |

| Outcome | Provides a detailed report of the home’s condition, including any recommended repairs. | Provides a valuation report that helps determine the home’s market price. |

Why Do You Need Both?

It’s easy to see why both a home inspection and a home appraisal are necessary parts of the home buying process. While they may seem similar at first, they address very different aspects of the transaction. The home inspection gives you a deep dive into the home’s condition, alerting you to potential issues and helping you avoid unexpected repair costs. The appraisal, on the other hand, helps ensure you’re paying a fair price for the property.

Having both processes completed offers peace of mind. The home inspection gives you the information you need to understand the home’s condition and make decisions about repairs or negotiations, while the appraisal confirms that you’re not overpaying for the home.

Conclusion

Although home inspections and appraisals are often part of the same process, they are distinct and serve different purposes. A home inspection focuses on identifying issues that could affect the safety or value of the property, while a home appraisal evaluates the home’s fair market value. Both are critical steps to ensuring you’re making a sound investment in your new home, and neither should be skipped.

If you’re about to buy a home, make sure you schedule both an inspection and an appraisal. These steps will protect your financial interests and give you the knowledge you need to make an informed decision. Call 407-644-6194 today!